How to choose a senior living property management structure

Although we don’t have a one-size-fits-all answer for how to choose a property management structure for a senior living facility, here are few guidelines to help owners decide.

What’s the best way to structure the arrangement between a senior living facility’s owner and operator?

The answer to that question depends on several factors. Before we dive into the pros and cons of each senior living property management structure, first let’s cover the basics of property management and explain the two most common arrangements seen in senior living.

What is property management?

A property manager is responsible for all the day-to-day operations of a real estate asset. In a traditional real estate asset, such as an office building or retail shopping center, a property management company is responsible for managing the facilities, maintaining the building, collecting rents, paying operating expenses, and preparing property-level financial statements for the property owner.

In a senior living facility, a management company has the added responsibility of caring for residents of the facility and marketing to the community to maintain occupancy. Because the management company operates the business, it is called the senior living operator.

Senior living property owners can engage an operator as either a fee manager or a triple-net (NNN) lease manager (also called a tenant operator).

There’s no right or wrong answer when choosing a senior living property management structure.

Fee manager vs. triple net (NNN) lease manager

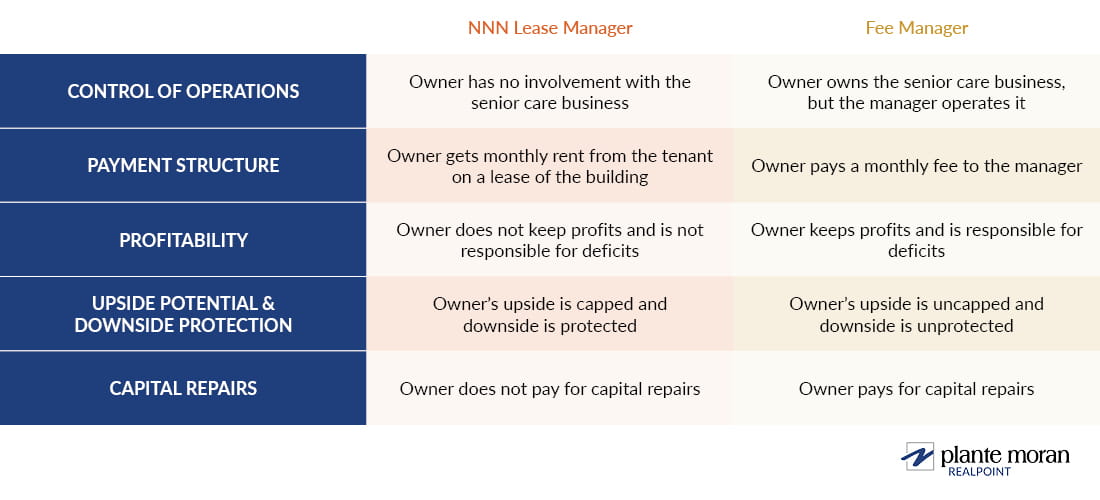

The main distinction between a fee management structure and NNN lease arrangement is who controls the operations of the senior housing and care business.

In the fee management structure, the property owner pays an operator a fee to manage the senior living operations on its behalf. In the NNN lease arrangement, the operator becomes the tenant of the building and is responsible for paying base rent and all of the other costs of real estate ownership. The owner in this case gets a rent check every month, but otherwise has little to do with the care of the seniors.

There is an option for the owner to have more influence over the operations of the property under a fee management structure. Since the manager is only paid a set fee, it may not ultimately be responsible for bottom-line profitability of the facility. So, in some cases, the owner can ask, or obligate, the manager to operate the building in a particular way. On the other hand, a NNN tenant operator is responsible for profitability; therefore, the property owner does not have any influence over the operations of the facility.

Other differences in these management structures include payment arrangements, profit sharing, and responsibilities for capital improvements and repairs. Here’s a summary of the differences, which we will explain in detail below.

Property owner’s perspective on management structures

Who captures the business profits, the senior living property owner or operator?

Under the fee management structure, after the property owner pays the manager, it ultimately benefits from a profitable operation or is responsible for covering operating deficits. The owner’s downside and upside potential are uncapped.

Under a NNN lease structure, the building owner only collects as much rent as its lease allows for. The owner does not have the potential for covering operating deficits or benefiting from a profitable operation. The owner’s upside and downside are capped.

What payment structures exist between senior living property owners and operators?

Under a fee management structure, the property owner pays a fee to the senior living operator for its services, usually a percentage of the gross revenue. The main concern with a fee manager’s payment structure is that the operator is incentivized to increase only top-line revenue, not necessarily residual operating profits at the bottom line. Put another way, it is possible for the fee manager to increase operating expenses by more than it increases revenues, which would increase the manager’s fee while reducing profitability to the owner.

For example, a fee manager in a senior care facility with low occupancy might hire more care staff to increase quality of care and more marketing staff to increase census. However, it could be the case that even as revenue increases from these efforts, so does the operating costs, resulting in a net loss of profitability to the owner.

Under a NNN lease structure, the operator, as the tenant, would pay the building owner rent to operate the facility, as mentioned above. The NNN lease structure is only feasible if the facility generates sufficient cash flow for the tenant operator to pay rent and still collect a residual operating profit for itself.

Does the senior living property owner or operator handle capital repairs?

While each individual transaction can have a slightly different structure, in general, under a fee management structure, capital improvements and repairs are the responsibility of the property owner. Under a NNN lease structure, capital repairs are the responsibility of the tenant.

What senior living property management structure should you choose?

As you begin your search for the right senior living operator, you will find that some operators prefer a management fee while some prefer a lease. In many cases, a manager will prefer a management fee because it alleviates the risk of operating deficits and capital repairs. Owners may lean toward a NNN tenant operator instead for much the same reason.

There’s no right or wrong answer when choosing a senior housing management organizational structure. As a property owner, your expertise, desired level of involvement, and risk vs. reward tolerance should drive this decision.

If you are an owner looking for an operator for your senior housing facility, Plante Moran Realpoint (PMR) and Plante Moran Living Forward offer a robust senior living operator RFP process that teases out the right property management structure and helps you locate an operator. Contact our team today for help thinking through your options.